Insights

An opportunity that mustn’t be missed

Conservation financing could help protect Canada’s ecosystems

Rally Assets and The Nature Conservancy of Canada researched conservation financing in Canada – the current state of the sector as well as its potential. Here, the Rally team presents an overview of their findings.

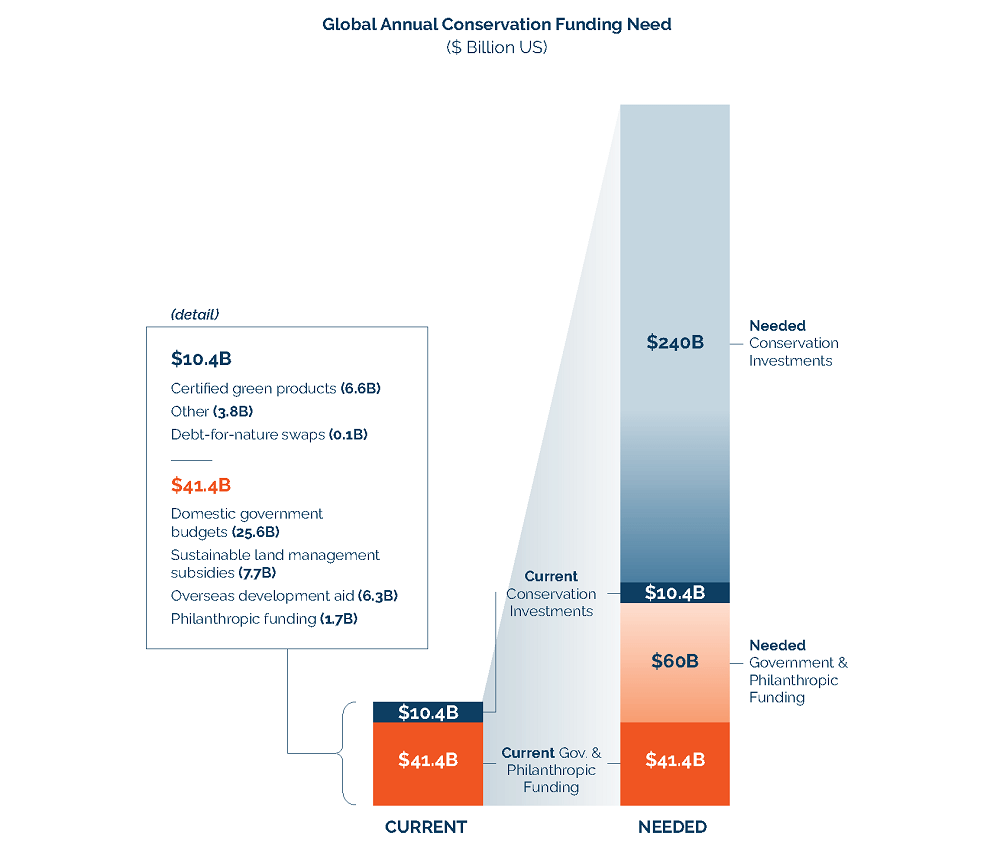

Conservation finance is an important and necessary tool to help protect ecosystems, and it is one being used around the world to restore and conserve healthy terrestrial and marine ecosystems and restore clean air, fresh water and species diversity. To be most effective, conservation globally requires significantly more funding. We estimate that in Canada alone the additional funding needed is $20-26 billion a year.

Traditionally, the main stakeholders in the conservation finance landscape have been governments, government-aligned institutions, land trusts and other nonprofits, philanthropists and philanthropic organizations. However, conservation finance also offers opportunities for private investors, mainstream investment firms and corporations interested in a triple bottom line of serving people, planet and profit.

Conservation finance offers these groups many benefits:

- For traditional players, it offers the ability to achieve total portfolio activation and program innovation and education, and to meet donor attitudes and interests

- For private investors, conservation finance can increase asset quality, develop long-term sustainable returns, tap into growth in emerging markets, diversify and hedge portfolios, utilize tax advantages or credits, and avoid or reduce costs

While nature is priceless and invaluable, there are many ecosystem services that have monetary value to various stakeholders, such as carbon sequestration or flood risk mitigation. Monetizing these services allows stakeholders to create mechanisms and products to measure, finance and promote conservation initiatives, based on the outcomes they provide.

High potential outcome areas include:

- Indigenous-led or -stewarded conservation in which stewards are compensated for their conservation efforts

- Blended social and environmental outcomes that are relevant to other communities, such as nature-based tourism communities, cities and peri-urban areas

- Offsets and credits supported by natural capital stocks other than carbon, such as biodiversity or nutrient credits

- Conservation finance models that provide the mechanisms to monetize ecosystem services including credits and offsets, outcome-based models, green bonds and other alternative investments.

Our research has found that while the conservation financing sector in Canada is nascent, there is great potential for conservation-related investment products in Canada. We must act quickly to turn the potential into reality.

Innovative Research

Working with the Nature Conservancy of Canada, we’ve set out the state of conservation financing in Canada and how it could protect Canada’s ecosystems.