Insights

Finding Conservation Answers by Asking Why

Finding conservation answers by asking why

By Karolina Kosciolek, Manager, Client Services

To thoroughly research conservation financing as a tool for the private sector to participate in the protection of Canada’s ecosystems, I spent dozens of hours reading countless reports and reviewing others’ work and opinions… in order to answer just one question: Why?

- Why has conservation financing been successfully used in this one instance, yet not in this other?

- Why have groups used one model of securing investment and not another?

- Why are certain players or regions heavily involved already but others are not, despite a clear alignment of purpose and huge opportunity?

That continual questioning helped me and my colleagues better understand conservation finance. We were able to distill various global approaches into a best practice financing model that could be used here in Canada by the whole range of traditional and non-traditional players, on initiatives of various sizes and with various ecological objectives.

Though these financing models and their real-life application may seem complicated, they aren’t really. Success primarily boils down to two key points:

- It’s all about partnerships. Many partners are required, with each partner bringing specialized knowledge and expertise and their own perspective. If partners are left out, or the relationships between different partners are weak, the initiative will likely fail altogether or not deliver the potential impact.

- Financial returns must move in tandem with impact. Investment needs to clearly lead to positive impact and that impact to financial returns, which then support further investment. This could mean that returns are explicitly structurally tied to the level of impact, or if not formally tied, at least operating in tandem.

Successful model

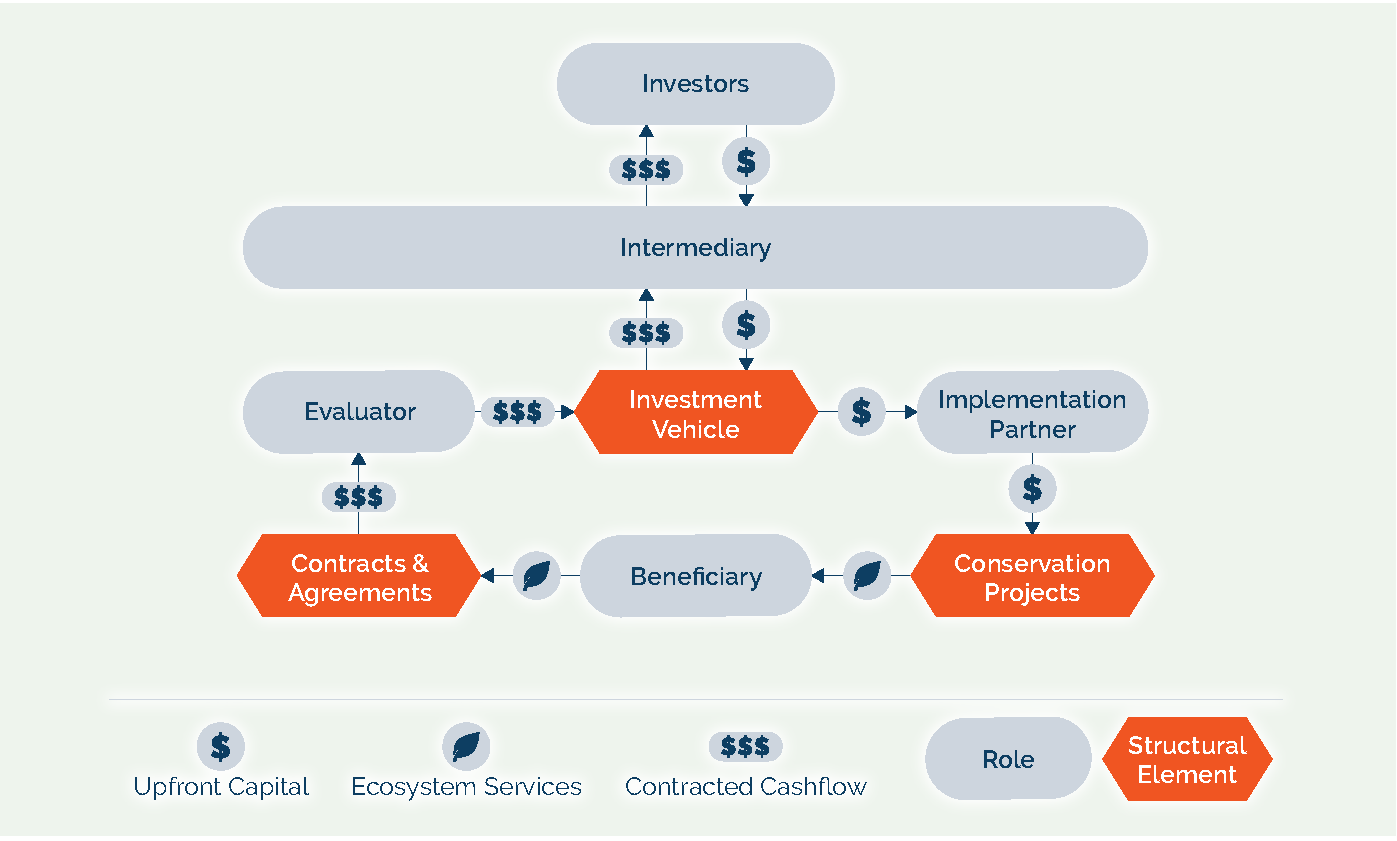

In our recently published research, you can read many real-life examples of the financing model in action. In general, as the graphic below shows, the model can be described in the following way:

- Investors provide upfront capital to an intermediary that structures and manages an investment vehicle. Project outcomes are established during the structuring process

- This investment vehicle provides funding for conservation projects, which are executed or overseen by an implementation partner

- Those conservation projects create value for beneficiaries, who share some of that value with the investment vehicle through contracted cashflows

- Generally, a third-party evaluator verifies the achievement of project outcomes and/or the valuation of the associated benefits to permit the funds to flow back to the intermediary

- The intermediary coordinates cashflows back to investors

You can be a player

Historically, the main players in the conservation finance landscape have been governments, government-aligned institutions, NGOs, individual philanthropists and philanthropic organizations. However, there are huge opportunities for participation from individual investors, mainstream investment firms and corporations interested in a triple bottom line of serving people, planet and profit. And as our report shows, we simply cannot achieve the required conservation outcomes without substantial participation from the private market.

I think one reason participation has been low up until now from those non-traditional players is because those players don’t see how they can be involved beyond the role of an investor. But without their participation upfront in the creation of these opportunities, we cannot build out the supply of conservation finance investments that are needed. I hope our new research, case studies and clarification of a successful model helps to change that.

Are you one of those non-traditional players? I’d be happy to talk to you further about how – and why ???? – you might get involved in conservation financing. Please contact me.

Working with the Nature Conservancy of Canada, we’ve set out the state of conservation financing in Canada and how it could protect Canada’s ecosystems.