Insights

Investing for justice

Part 2: How

Investing for Justice

Part 1: Why | Part 2: How

By Ammara Shirazi

As Part 1 of this series explained, social and racial justice is a complex and sensitive systemic issue that can make people feel uncomfortable. Systemic inequalities in the financial sector reinforce systemic inequalities in society. However, if we are going to commit to learning and striving for change, then the issues need to be faced in order to overcome them. At Rally Assets, we work to reduce those inequalities by how and where we invest our clients’ capital.

Inequality is multi-layered

An individual’s identity, position in society and power in the world are the result of many interconnected, overlapping and intersecting factors. It is unhelpful and incorrect to consider just one aspect when assessing the impact of a program or an investment. A reductive analysis – say, based solely on skin colour, will not result in a real understanding of inequalities in this world and how to resolve them.

The term intersectionality was coined in 1989 by Kimberlé Crenshaw. She saw that people were looking at issues as standalone and there were no frameworks that layered them all together to understand the interplay of the various aspects of our identities, such as gender, race and class. These layers provide us with certain advantages and disadvantages, some of which are easier to see than others. The image below illustrates the many layers that overlap to make up our identities, experiences and views.

Adapted from John Hopkins University

Investors can begin to achieve social and racial justice by using an intersectional approach. The approach allows for consideration of the multi-faceted layers affecting different groups, which should result in solutions that lead to increasing the economic livelihoods to communities and individuals that have typically been excluded.

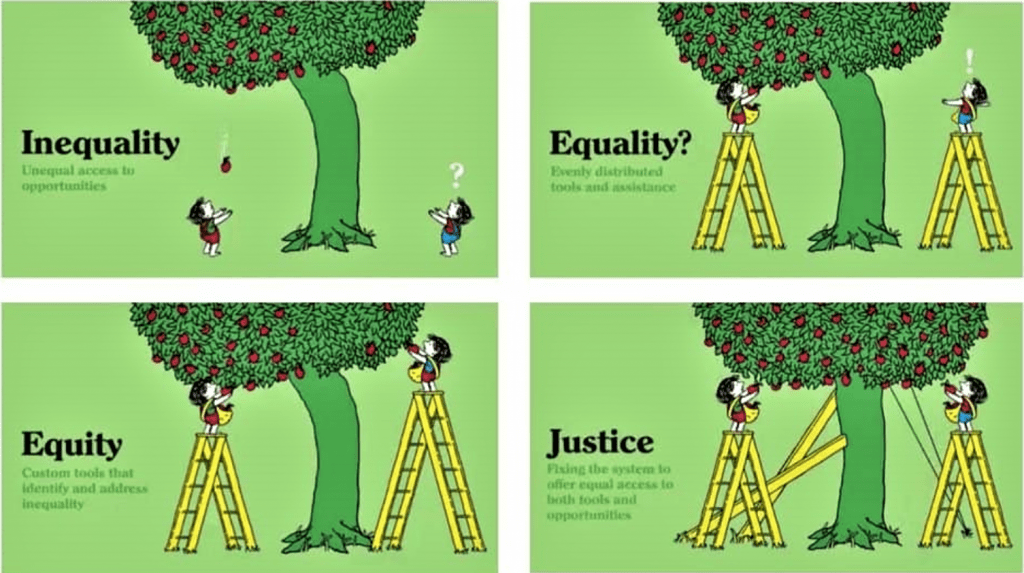

Just to be clear (as the language can be confusing or inconsistent) at Rally, ultimately we strive for justice, not equality or equity. The image below outlines the differences, but we must acknowledge the oversimplification these illustrations provide since unequal or unjust systems do not just appear but evolve from reinforcing biases. These biases influence behavior, rules, practices, laws, social norms and more. Similarly, achieving justice or dismantling unjust systems is not that easy to achieve.

- Equality gives everyone the same platform to stand on regardless of the differences between them

- Equity takes differences into consideration

- Justice seeks to fix the system to create equal access and opportunities for all

Source: Design in Tech Report 2019

Lenses help us see and address injustice

Different lenses are used to understand the positive and unintended negative impacts that could be created with investment decisions.

Gender lens

According to the Criterion Institute, gender lens investing seeks to identify investment opportunities that have a positive impact on the lives of women and girls via gender equity in the workplace, access to capital for women, and products and services that benefit women.[1] Although in most instances gender refers primarily to women and girls, the struggle to attain gender equity also includes LGBTQ+ people. By utilizing an intersectional approach, we know that gender is woven into other systems such as education, political, economic, legislation, tradition and cultural norms.[2] Thus, rather than simply counting the number of women and girls as beneficiaries we aim to understand how all financial and investment decisions impact them.

Racial justice lens

The Philanthropic Initiative for Racial Equity (PRE) states that the racial justice lens “bring[s] into view the confrontation of power, redistribution of resources, and systemic transformation necessary for real change”.[3] According to PRE there is a key distinction between racial equity and racial justice lenses that are used to understand and take into consideration racial disparities (see image below).

Source: Philanthropic Initiatives for Racial Equity

Using lenses at Rally

At Rally, we use different lenses to look at what companies do and how they operate. If we unpack this, there are three main pillars that we assess at when assessing a fund manager or company for investment: increasing access to capital, workplace equity and products and services.

For private markets, a lot of this analysis is done by speaking with fund managers and companies to understand their strategy and impact approach. This is taken one step further to verify the work of fund managers to see what they have delivered and followed through on. With public companies, there are public resources and tools that offer some insight into specific issues. However, given the complexities and nuances in addressing these issues for each company, the level of information or disclosure is somewhat inconsistent and not timely, relevant or comparable in all cases. Rally digs deeper. For example, a company may be given a high rating for its commitment to gender equality but score poorly on another dimension because its products and services are linked to private prison industrial complexes which negatively impact diverse communities.

With greater understanding and commitment, considered actions can be positively impactful

Investors have a key role to play in changing how and who receives investment. They can help achieve social and racial justice by acknowledging systemic inequities and taking an intersectional approach.

At Rally we often meet investors who are new or early in their impact journey. At this stage, investors are looking to understand the market, issues and investment themes. The education and strategy approach we use at this juncture will inform the investment policy statement that investors use as a guide to deploy capital. We help clients to understand the implications of their decisions and these issues. Given our privilege and influence we also need to be held accountable for how we move this conversation forward with our clients through strategy development, deal sourcing, due diligence and investment recommendations.

We will be the first to admit that Rally has not done enough to tackle racial injustice. This is changing. We are having more open, honest and raw conversations internally and with investors about what role they have played and can play to achieve social and racial justice. Internally we are deepening our approach to address anti-Black racism in our policies and procedures, educating ourselves, doing an anti-Black racism portfolio review for our funds and clients’ portfolios and updating our investment process to reflect our learnings.

Practical steps

Some of our clients have found the following suggestions to support justice to be helpful. You may find the list helpful too:

- Learn more about social and racial injustices in society and the financial sector (For example, our team took part in the AntiRacist Table challenge)

- Recruit and promote diverse talent

- Review your investment philosophy and approach

- Integrate an intersectional approach and the three pillars analysis into the investment, portfolio and fund management processes

- Review your existing investments in the portfolio to understand how they are advancing social and racial justice

- Be open to different decision-making processes or frameworks

- Activate endowments by speaking with external investment managers to see how they are integrating or understanding the approach they are taking for social and racial justice

- Consider alternative ways to assess capabilities of first-time fund managers who have limited track records. For example:

- Do they have a track record while with an investment team in another firm?

- Are they aware of what has and has not worked in past investments? What challenges and lessons did they learn?

- What skills does the team possess and where did they learn to invest?

- Break the Catch-22 of needing to already a track record before raising funds by seeding a smaller investment

- Ask questions of non-diverse fund managers and strategies:

- What is your strategy to support communities that have typically been excluded?

- If social and racial justice is not a core part of your current strategy, is this something you are seeking to integrate and how?

- Report and evaluate

- Report back to investors, investees and the industry on how taking these actions have impacted your processes, portfolio, investees, beneficiaries and the sector

- Create a feedback loop that allows you to update your strategy or processes as a result of this work

We would love to continue the conversation with investors and groups that are:

- Using novel and innovative approaches to create justice

- Wanting to learn how to integrate justice into investment processes

- Offering investment opportunities that support justice

Please reach out to us at info@rallyassets.com.

[1] https://criterioninstitute.org/resources/framework-defining-a-gender-lens

[2] Criterion Institute, Gender Handbook: A Guide to Understanding Gender Terms, Analysis, and Applications to Social Investing, 2012

[3] Philanthropic Initiative for Racial Equity, Grantmaking with a Racial Justice Lens, 2019